WhatsApp: +98-9171792581

WhatsApp: +98-9171792581  Telegram ID: @aayateam

Telegram ID: @aayateam

📌 Basic Technical Indicators in Forex Trading 📊

📌 How Can You Analyze Markets and Forecast Price Movements? 🤔

✅ In the Forex market, traders need powerful analytical tools to understand market trends and identify optimal entry and exit points.

✅ Technical indicators are mathematical tools based on price movements and trading volumes that help make more accurate trading decisions.

🔹 1️⃣ What Are Technical Indicators? 📊

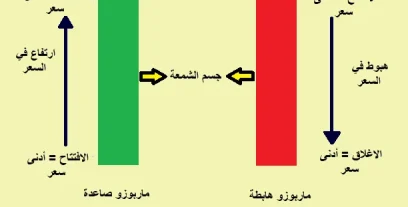

✅ Technical indicators are computational tools relying on past price data such as open, close, high, low prices, and volume.

✅ They are used to analyze the market, identify trends, momentum, and volatility.

🔍 Types of Technical Indicators:

📌 Trend Indicators 🚀: Identify the overall market direction (uptrend or downtrend).

📌 Momentum Indicators ⚡: Measure the strength and direction of price movement.

📌 Volatility Indicators 📉: Assess price fluctuations and market activity level.

📌 Volume Indicators 🔍: Track trading volume to confirm trends.

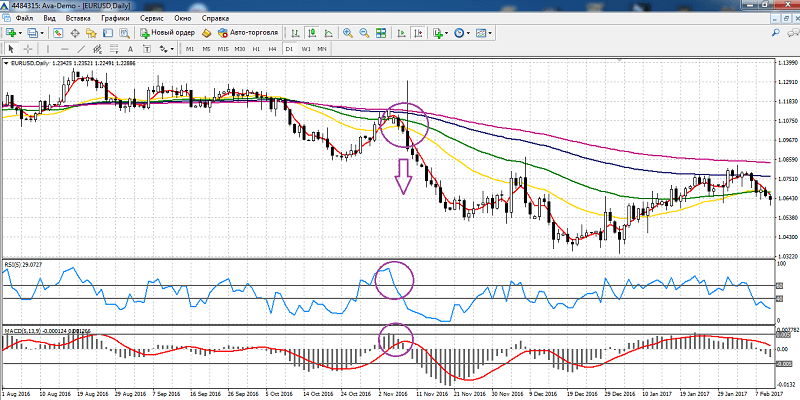

🔹 2️⃣ Moving Averages (MA) 📈

✅ Moving averages are among the simplest and most essential indicators used in Forex.

✅ They calculate the average closing prices over a specific period, helping to identify trends and filter out market noise.

📌 Types of Moving Averages:

1️⃣ Simple Moving Average (SMA) 📊: Calculates the average price over a set time period.

2️⃣ Exponential Moving Average (EMA) 🔥: Gives more weight to recent prices, making it more sensitive to new changes.

📌 How to Use:

✔️ Price above the moving average → bullish trend 📈.

✔️ Price below the moving average → bearish trend 📉.

✔️ Crossovers of moving averages (e.g., EMA 50 and EMA 200) can provide strong buy or sell signals.

📉 Drawbacks:

❌ May be slow to react to sudden market changes.

🔍 Best Use:

✅ Ideal for identifying long-term trends and spotting major trading opportunities.

🔹 3️⃣ Relative Strength Index (RSI) ⚡

✅ RSI is a momentum indicator measuring the strength or weakness of the current trend.

✅ It ranges from 0 to 100, indicating overbought and oversold conditions.

📌 How to Read RSI:

✔️ RSI above 70 → Overbought market (potential downward correction 📉).

✔️ RSI below 30 → Oversold market (possible upward reversal 📈).

📌 How to Use:

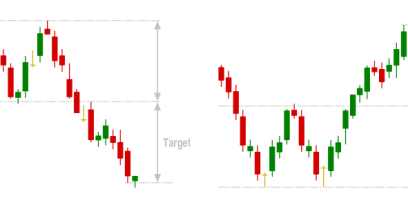

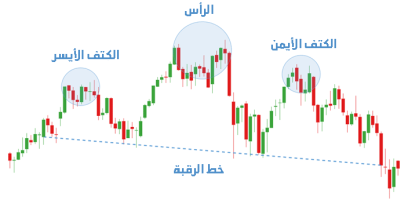

✔️ Detect trend reversals.

✔️ Divergence between price and RSI may signal an upcoming reversal.

📉 Drawbacks:

❌ Less reliable in strong trending markets.

🔍 Best Use:

✅ Excellent for timing entries and exits, especially when combined with other indicators.

🔹 4️⃣ Moving Average Convergence Divergence (MACD) 📊

✅ MACD is a strong momentum and trend-following indicator widely used in technical analysis.

📌 Components of MACD:

1️⃣ MACD Line: Difference between two EMAs (usually 12 and 26 periods).

2️⃣ Signal Line: EMA of the MACD line (usually 9 periods).

3️⃣ Histogram: The difference between the MACD line and the Signal line, showing momentum strength.

📌 How to Read:

✔️ MACD line crosses above Signal line → Buy signal 📈.

✔️ MACD line crosses below Signal line → Sell signal 📉.

✔️ Positive histogram → Increasing bullish momentum.

✔️ Negative histogram → Increasing bearish momentum.

📌 How to Use:

✔️ Identify trend beginnings and endings.

✔️ Combine with other indicators to improve analysis accuracy.

📉 Drawbacks:

❌ May produce false signals in sideways (range-bound) markets.

🔍 Best Use:

✅ Ideal for momentum analysis and confirming trends when combined with other tools.

🔹 5️⃣ Comparison of Basic Technical Indicators 📊

| Indicator | Type | Main Use | Drawbacks |

|---|---|---|---|

| Moving Averages (MA) 📈 | Trend Indicators | Identify main trends | Slow response to sudden changes |

| Relative Strength Index (RSI) ⚡ | Momentum Indicators | Identify overbought/oversold levels | False signals in trending markets |

| MACD 📊 | Momentum + Trend | Detect reversals and trends | Ineffective in sideways markets |

🔹 6️⃣ How to Use Technical Indicators Smartly? 🧠

🚀 The best approach is to combine indicators for more accurate signals!

📌 Example of an Integrated Strategy:

✔️ Use moving averages to identify the general trend 📈.

✔️ Use RSI to check if the price is in an overbought or oversold zone ⚡.

✔️ Use MACD to confirm entry and exit signals 📊.

✅ When all three indicators agree on the same trend, the trading opportunity is stronger and more reliable! 💪

💬 What’s your favorite technical indicator for trading? 🤔 Share your experience with us in the comments! 👇🔥

Comments (0)